Answers to the most frequently asked investor questions

In 2015 Brighter Investment supported the first high potential students in Ghana. The deal is: we pay for their higher education, and after graduating students repay our investors a percentage of their income, typically 25% for 6 years. After investing in a second cohort in 2016 and a third cohort in 2017, we shared a blogpost last month that describes that our model works and is an attractive investment with tremendous social impact.

Following this post we received many questions from interested investors. Here are our answers to the most frequently asked questions:

1. Why don’t your students get a loan from a bank?

Students at university of Ghana ready to start a successful career. At the moment most university students are funded by their family and a degree is unattainable for students from a poor family.

The simple answer is, because banks don’t provide students with loans. The majority of people in developing countries don’t have a credit rating, nor can they provide the collateral that banks ask for.

Microcredit loans are usually available to the families of our students. The problem with microcredit loans is that the annual cost in fees and interest is between 30% and 50% of the loan amount (also if you fund a student on the Kiva website!). The result is that these loans are only used for for example the one off costs of a laptop or annual tuition fees, to be repaid over the course of a couple of months by richer family members. Microcredit loans are not a suitable solution for financing a full multi year degree.

The funny thing is, a GOOD degree increases a graduate’s income by so much, that the 30-50% per year can actually be affordable for a successful student. The problem is, success isn’t guaranteed and an expensive loan like this, worth easily 5 times the family’s annual total income, just wouldn't be a realistic solution. That’s one of the reasons our model is based on a percent-of-income repayment where successful students repay a bit more, unsuccessful students repay a bit less, and no student ends up with insurmountable debt. Our percent-of-income repayment model also helps reduce the exchange rate risk for investors, but that's the subject of question 5.

2. Is the repayment rate fair to the student?

For 4 years of financial support, a typical Brighter student repays 25% of their income for 6 years following their graduation. A typical North American student repays a similar portion of their income to pay off a full student loan over the same time period. However, with their degrees, Brighter students increase their income 5X on average. Graduates in the developed world increase rarely increase their income more than 2X. This means that already during the repayment period, our students are significantly better of than they would have been without a degree. This fact, combined with a percent-of-income repayment model where students with a low income repay little or even nothing at all, ensures that every student benefits from our financing.

Our income dependent repayment means that if inflation is high, and wages keep up with inflation by salary increasing in the local currency, effective interest rates can be high for successful students. But even under extreme circumstances, effective interest rates stay within a reasonable bandwidth in the context of developing markets with high inflation. Much more important to the student than the effective interest rate, is that the inherent value they repay is constant, and remains easily payable under all circumstances.

For more information on the advantages of our percent-of-income repayment model, for both students and investors, please take a look at this blogpost.

3. What percentage of your students are women?

Joy, our community manager in Ghana that has received funding from Brighter Investment to pay for her MBA, is a fierce advocate for increasing the % of women in our cohorts.

12% of our applicants and 12% of our students are female, and increasing this number is one of our top priorities. There are a couple of difficulties we need to overcome to accomplish this: The first one is that we invest in those degree programs that offer the best career prospects and create the most value for students and investors. These degree programs are mostly in the areas of science, technology, engineering, finance and other degrees that traditionally attract a much larger male than female audience. Secondly, for the families of the demographic that we serve, if they have the financial means to only get one child a high school diploma, available funds are much more likely to be invested in a son than a daughter.

We are deploying a number of initiatives to circumvent these difficulties while keeping investor returns high:

Female Brighter students visit high schools to talk about their technical education and resulting job opportunities. They serve as role models to younger women and inform their audience about the financing options available through Brighter Investment.

We’ve signed a partnership with World University Services Canada (WUSC) to help us identify and address barriers that women face before their application, barriers as part of the application, barriers while studying and barriers in the job market. Having been a leader in this field for years, WUSC will help us address these barriers.

We’re developing our student selection algorithm to look deeper for talent than superficial grades and attainment. Women who've faced challenges trying to complete high school have probably developed other skills, and we are getting better and better at picking up on those.

The sponsorship agreement we sign with our students has flexible clauses in place to deal with graduation delays or temporary unemployment. This allows our students to effectively deal with for example parenthood or temporarily having to stay home to take care of a sick parent. These clauses are also beneficial to male students, but more so to women due to societal expectations put on them.

As a daughter’s education is often not the highest priority when limited family finances are budgeted, women are disproportionately affected by the lack of alternative financing options for their education. Our objective is to completely change the current system and ensure that all talented students can reach their full potential, irrespective of gender, religion and other irrelevant aspects.

4. How do you ensure your students find jobs?

By far the biggest factors that determine our success are 1) selecting the brightest students and 2) supporting degree programs that are in high demand by employers. Every year we work with our partner universities to reach out to their alumni, we ask these alumni about their career progress, unemployment and income. The results of this research tell us what degree programs offer the best career prospects now, and what trends there are in the labor market. We use these results to provide our investors with a diversified portfolio of high potential students.

To further help ensure our students' success, we’ve developed a mentorship program for them. At the start of their education the focus of this program is on academic success, later on this focus shifts to experience building, employability, networking and applying for jobs. After graduation and during the first years of their careers mentors support our graduates with career advice. Are mentors critical to our student’s success? No, but they improve our student's success to such an extend that running the mentorship program is a worthwhile investment.

The terms of our student sponsorship agreements vary from degree to degree to reflect differences in earning potential. This market driven approach doesn't only ensure that we realize our targeted return, it has also proven to be an incentive for education providers to improve the job relevance of their programs. In the long term, this effect will further improve student success and value creation.

5. What are the biggest risks for investors?

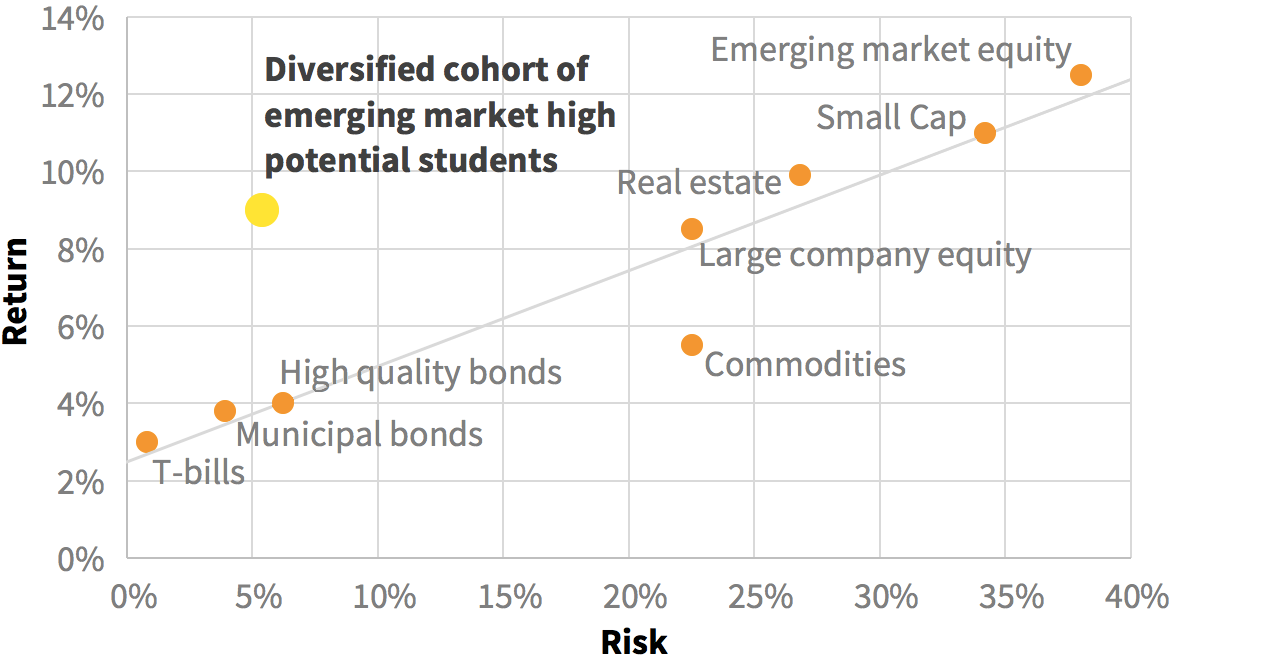

20 years of return and risk (return standard deviation) for average university students in developing countries. Our high-potential students outperform these projections.

The first concern from investors is usually related to the predictability of student income. How do we know that students will find jobs and that they’ll earn enough to make the investment worthwhile for the investor? To answer this question, we have 20 years of historic data on graduate income in developing countries. This data not only shows a 9% ROI from the average university grad, it also shows that the volatility of this return is around 5%, including periods of high inflation and volatile exchange rates (this FX-risk is the second most asked about risk). This low volatility makes diversified cohorts of emerging market students an attractive asset class as depicted in the graph.

But how do we ensure that students repay? One factor that really helps to keep default rates low is that income-based repayment ensures that graduates won’t default due to an inability to pay, as no income means no required repayment. Legal hurdles, a local collection company on standby if needed, and the ability to request tax returns from the Ghanaian Tax Authority help to further reduce default risk. But, as proven by microcredit loans over the last decades, social hurdles to default are much more effective: a teacher that recommended the student and wants to continue to recommend new students, a mentor that has worked with the student for years, a family member that has signed as a guarantor, all these provide social pressure points to ensure students continue to make their monthly repayments. The aforementioned 9% return for average students includes a default rate conservatively projected at 15%. As our selection is designed to pick students that represent the best investment opportunity, our students are performing significantly above average academically, they also earn more than average and are unemployed less. A focus on honesty as part of the selection process has helped with ensuring that default rates to date are 0%.

The interesting aspect of our model is, that for an early stage enterprise, there is a lot of data available on all the important risk factors mentioned to this point. The available data is all based on average students, so as long as we continue to select above average students, these risks can be conservatively priced into our projections.

In our opinion, the largest uncertainty for investors is less related to student performance, but instead our company's performance: will Brighter Investment be around in 10 years to collect on those last repayments? Since the 5% management fee over repayments is more than enough to cover collection costs, even if Brighter Investment isn’t around to support new students, collection operations can continue to serve the existing sponsorship contracts to term. As we've invested in our own students we have a personal interest to ensure that this happens.

Interested in more details about the risks and our mitigation strategies? Contact us for the dedicated risk document we wrote for investors.

6. How do you source your students?

Our objective is to provide investors with diversified cohorts of the best students. To accomplish this, we use three different channels to reach new students:

We have 6 partner universities in Ghana where we support the degrees that offer the best career prospects. If a student faces payment problems, the university's financial aid offices inform students about our program. This channel mainly provides us with continuing students about to drop out of university due to financial difficulties.

We advertise online for search terms like scholarships and student loans. Nowadays even the poorest students have a Facebook account and find ways to go online and update their profiles once in a while. As almost no other organizations are interested in our target market, nobody is bidding on these ad positions and our cost per click is less than a cent. Online advertising allows us to reach students that are interested in pursuing a degree, but are unsure how to pay for it.

To support our program, the Ghanaian National Teachers Association has provided us with the contact details of all high school headmasters in Ghana. Early in the school year we call these headmasters and ask them to recommend their best students to us. This allows us to reach students that are currently wondering why even bother studying for their final exam as higher education is a financial impossibility anyway.

To qualify for the program, students require a recommendation and completed assessment from one of their teachers. Not only does this provide valuable input for our selection method, it also provides us with a point of contact for new students year after year. In addition to the teacher assessment, a student questionnaire and parent assessment are combined, compared and used to score students based on early predictors for academic success, early predictors for career success and likelihood of repaying. This selection, or underwriting method, allows us to pick students that will use our investment to create the most value for themselves and our investors.

7. What are your impact metrics and what do you hope to accomplish in the long term?

Slide at Katapult Fest 2018: Comparison of amount of philanthropic funding to impact investments and investments with an ESG focus. Traditional global assets under management dwarf these previous funding sources and have the capacity to really address financial barriers to higher education at scale.

The more successful our students are, the higher the ROI and the better the performance of our company. Incentives for students, investors and us as the 'portfolio manager' are very much aligned. This alignment means that social impact- and financial- KPI’s are similar: number of students graduated, number of graduates employed, increase in income realized etc. In 2-3 years we intend to also research secondary effects of our program, effects like increase in tax revenues, improvement of living standards for the family, additional jobs created through economic growth etc.

Our estimate is that 60 million high potential students graduate from high school every year without a way of paying for a degree. Educating this unserved market requires $600 billion dollar per year. With populations in Sub Saharan Africa and South East Asia expected to double over the coming decades, this number is only going to increase. Institutional investors are the only ones capable of providing enough capital to address this need. That’s why our objective is bigger than supporting the students that we help today: we are going to prove to institutional investors that high potential students in developing countries provide an attractive new asset class that is worth investing in.

Imagine a future where the brightest students in Sub Saharan Africa, Southeast Asia and Latin America don’t waste their talents as servers in the tourism industry or as subsistence farmers, but instead become leaders in science, tech, engineering, medicine and business. Please join us in making this bright future a reality.